A foreword from CEO Antony Chesworth

From what seemed like a temporary effect on business to now moving onto a more permanent change. The last 12 months have shown us and the world that online is the way forward not only for retail but businesses all over.

We’ve seen first hand the highs and the lows of what this virus has done from both a business perspective and a personal one. From people being made redundant, high street stores closing their doors permanently, and businesses being bought out. The landscape of retail and ecommerce has changed forever; some may say for the better some may not. But one thing is completely clear – ecommerce will drive the world forward.

The past 12 months haven’t just changed the landscape of retail but we’re now seeing the impact on consumer behaviour, including spending habits, the impact that media such as popularised TV shows are having on sales and so much more.

At this time, the UK is still in lockdown and uncertainty still looms over us. But it’s the tenacious drive of UK business owners, new and established that are helping to support the UK economy.

Mid-2020 EKM surveyed its customer base, asking for their thoughts, experiences and opinions on the impact of COVID-19 on their business. Our previous report explored the immediate effects that the UK lockdown and COVID-19 had on businesses, that account for 99.9% of the UK’s business population, with mixed but still positive results.

We believe that it’s important as a small business advocate ourselves to check in and re-evaluate the impact UK businesses are experiencing. Which is why we re-surveyed our customer base to see how the second and third lockdowns, the tiered system and Brexit amongst other things had impacted their world.

I hope that these results provide you with a clear picture of what UK business owners are experiencing and the challenges they face every day. And let’s not forget to support your local businesses as much as possible in 2021.

Introduction

EKM set out once again to investigate and report the effects of COVID-19, UK lockdown restrictions and Brexit is having on UK businesses. We surveyed our customer base, six months on from our previous survey, asking them about their thoughts, experiences and opinions. We took a focus on the UK lockdown, supply and demand and Brexit as these were the most highlighted factors influencing their businesses. Detailed in this report are the results from our customers’ anonymous answers which have provided us with great insight into how they’re currently being affected.

EKM is the highest rated ecommerce platform in the UK and has helped over 80,000 businesses sell online since 2002. We believe that everyone should do what they love which is why we feel that it is important to research how businesses are affected by COVID-19, Brexit and more.

Overview

Over the past 12 months, almost every part of our lives has been affected by COVID-19 and the subsequent impacts it had. From the beginning where many businesses and individuals sought support from our government, to the introduction of a tiered system that left an air of confusion and uncertainty for what the future held.

UK business owners have seen dramatic changes over the past 12 months, so this report will focus on the impact of COVID-19, six months on from our previous survey the impacts of lockdown restrictions as well as how Brexit has affected UK businesses.

The majority of participants operated their business online only as expected however there was an increase in participants who ran both a brick and mortar shop as well as an online shop, now at 42.8%. The participants also worked across a wide range of industries and locations within the UK.

We’re now going to deep dive into their responses, composed of thoughts, opinions and experiences and take a better look at how the landscape of ecommerce has changed, how this change will affect their business now and in the future.

Online vs offline

Over the past 6 months, EKM has seen an increase in the adoption of selling online. Primarily due to the impacts of the coronavirus but the world of online retail has been growing steadily for some time, but has seen exponential growth recently. According to ONS (the Office for National Statistics) in February 2020 internet sales as a percentage of total retail sales stood at 19.1% and quickly jumped to 32.8% in May 2020 and spiked again in November to 36.2% – the highest ever it’s ever been.

41.8% of participants answered that they also owned a brick and mortar shop. Whilst a larger percentage than the last survey, we also had more participants this time. However, it’s interesting to note that even though most non-essential businesses are closed, owners are retaining their brick and mortar premises.

Is this likely to change if they are not allowed to re-open soon? Would more business owners embrace the ecommerce path going forward to reduce their overheads; or will their brick and mortar shop boom if they’re permitted to open?

Over 40% of participants stated that they ran a brick and mortar shop

Brick and mortar closures

We’ve unfortunately seen many businesses closing their doors for good, from small independents to large corporations. The death of the high street has never been more apparent.

For those participants who answered that they ran brick and mortar shops, 95% stated that they have retained their brick and mortar premises and have no plans to close them. It seems that most brick and mortar business owners are still able to retain their physical shops even 12 months after the initial impact.

Nearly all of those with brick and mortar shops have retained and have no plans on closing

With a remaining 3% stating that they are considering closing their brick and mortar businesses permanently to move online and the other 2% stating that they have already closed their brick and mortar with no plans to reopen.

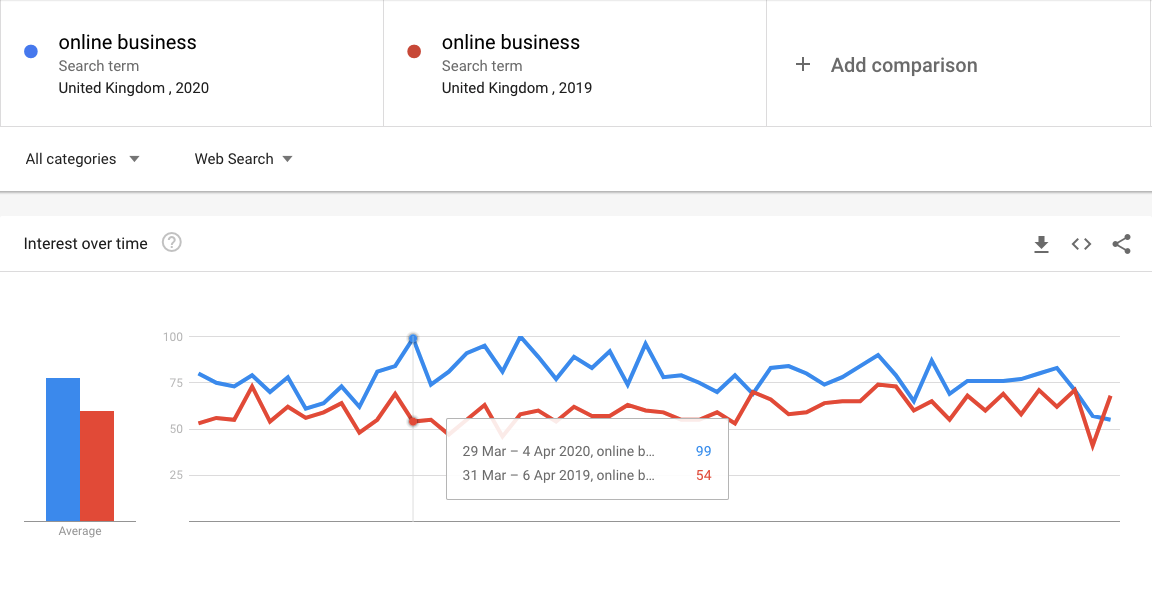

The search intent on Google trends for ‘online business’ has seen a significant uplift from 2019 levels. According to Statista the value of online retail sales in the UK was around £99.31 billion in 2020 – a huge jump of about £23.27 billion.

This isn’t surprising considering the lockdown restrictions put in place and the closure of brick and mortar shops. People needed to find their products online but it wasn’t simply a temporary change. More and more people are now shopping online than ever before and it doesn’t look like it’s going to change too much once brick and mortar shops reopen.

The UK lockdown

There has been a substantial shift in the way people shop. It’s become more commonplace for people to find items online and consumers are now becoming accustomed to finding what they want, for the price they want and getting it delivered straight to their door.

This isn’t just for products you’d expect to buy online but the weekly shop as well as services such as personal styling and much more. There’s one thing that’s now changed forever and that’s how we utilise technology. We have all been able to continue our lives from the comfort of our own homes – mostly. This is something that we don’t expect to change going forward but we do expect to evolve and improve over time; particularly when it comes to shopping.

The past 12 months and its challenges have forced most business owners to pivot how they operate and explore new avenues of reaching customers. Some have gotten really creative at how they do this and for some, simply having an online presence is enough. We’ve seen more opportunities for UK businesses online this year than ever before. Brand new businesses are being founded from people’s passion to turn their hobbies into a business or from more unfortunate circumstances. Like the number of redundancies made in 2020 which is now worse than rates back in 2008. People are taking their careers and incomes into their own hands and more businesses are being created than ever before – with this trend set to continue.

Nearly half of our participants stated that they had seen an increase in sales over the past year with 45% stating that they saw no adverse effects to their business from the UK lockdowns.

Nearly half of the participants reported an increase in sales over the past 12 months

An extraordinary result, given the circumstances and this also demonstrates the power of ecommerce when operating in the right industry. However 32% of participants reported a decrease in sales, whilst 20% reported no major changes. This result, however, is taken from business owners across many industries, where some will be more affected than others. We will look into each industry in more depth later on in the report.

We also asked our participants what concerns they had with regards to their business and whilst we had an overwhelming amount of other more specific responses the number 1 concern form participants was a decrease in orders (30.7%) followed closely by cash flow (29%), an increase in orders (20.1%) and finally business funding (14%).

“None. We’ve been too busy”

“Delays of deliveries from suppliers with out of stock problems”

“We sell through retailers. Many of them are closed. Our online business has helped us to survive”

We also asked about any other effects of the UK lockdown and COVID-19 restrictions. Many businesses could only offer delivery at 31% and second to that was that many business owners had to furlough staff (25%). Followed by those who could only offer click & collect services (14%) and those who had to close completely (10%).

The top result for this question was that 45% of participants had no other effects to their business because of lockdowns and restrictions.

45% of participants saw no effects from UK lockdowns and COVID-19 restrictions

It seems that whether you’ve blossomed or not over the past 12 months has relied heavily upon many different factors including your industry, what kind of products you sell as well as your marketing strategy, given the changes within the ecommerce and retail industry.

Brexit

The end of 2020 also marked the end of the transition period for the UK leaving the EU. Businesses have been preparing for this date for many months and in the run-up to it, the information available perhaps added to the confusion about what UK business owners needed to do to prepare.

We asked our participants about how Brexit has affected their business in the run-up to the end of the transition period and beyond. 64% of participants stated that they had experienced delays in restocking items within the past 12 months. Reporting delays of just a few days (6%), a few weeks (44%), a few months (28%) and three months or longer (22%).

Nearly half of respondents reported delays in being able to restock products for a few weeks

However, 64% are reporting that sales volumes to customers based in the EU are roughly the same, whilst 34% are reporting that sales have significantly decreased. Whilst this and many other aspects of this report are heavily based on what industry the participant operated in, we can see how this is affecting and shaping the way we both operate with the EU, how businesses are dealing with it.

6% of respondents also stated that changes to trade credit terms by their suppliers had harmed their cash flow over the past 12 months. Something that impacts small businesses.

Alongside this over one-third of respondents noted that sales volumes since the end of the transition period have significantly decreased. Meanwhile, 64% state that sales volumes are roughly the same. This could be dependent upon industry type as well as product type, and supplier. But this has impacted 18% of respondents who state that they have switched or are looking to switch to non-EU suppliers for some products.

18% of respondents are looking to or have switched suppliers

But what does this mean for rising costs? 15% of respondents state that they are choosing to absorb all these costs themselves whilst just under 20% are passing the cost onto customers and a whopping 43% are doing a combination of both.

Finance

The effects of COVID-19 and the resulting lockdowns that the UK government has implemented over the last 12 months have had a severe impact on everyone’s finances. Even with support like the furlough scheme introduced, whilst only receiving a portion of their regular pay, people were put into financial worry. Unfortunately for some, this also resulted in them losing their jobs, for business owners, losing their staff, their stability and for some much more than that.

Respondents of the survey were also asked if they had deferred any taxes due over the past 12 months, i.e. deferring the 31st July payment on account or entering into a Time to Pay arrangement with HMRC (Her Majesty’s Revenue and Customs). An overwhelming majority, around 86%, answered no to this question.

With the rise of online payments increased tenfold during this time and adoption of buy now pay later options much more widely accepted – we wanted to know how our customers felt about this and if they were planning on adopting a buy now pay later option on their online shop.

15% reported that they had already introduced buy now pay later and 11% are planning to. However, nearly three-quarters (74%) have not and are not planning to introduce buy now pay later on their online shop.

Thoughts and opinions

Clearly, the after-effects of Brexit, COVID-19 and the UK lockdowns are all having adverse effects on UK businesses. But how are these affecting individual industries?

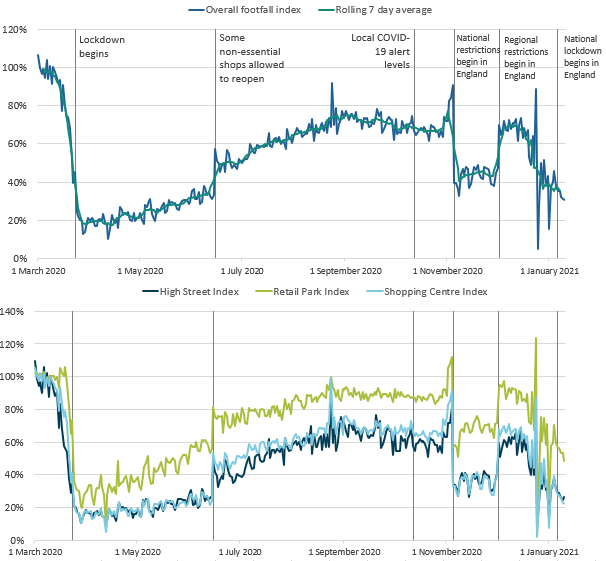

The first lockdown saw the closure of offices, schools, high street shops and more with everything moving to work from home practices and online solutions. When some restrictions were lifted, some high street shops were allowed to reopen with some conditions but the unknown of the COVID-19 virus was still putting pressure on footfall.

According to the ONS (Office for National Statistics), overall footfall dropped to 38% of the level seen in the same week of the previous year in January of 2021. This is still higher than the initial drop in footfall to less than 20% in April 2020.

But it isn’t too promising for UK high streets regardless of whether they’re allowed to open within the next 6 months as the UK’s Prime Minister, Boris Johnson set out in his roadmap.

People may still be cautious of shopping in-store after the 21st of July 2021, which may still affect footfall levels compared to previous years. People have also become accustomed to purchasing their items online over the last 12 months. Many of them may have discovered the convenience of ordering online and continue to do so.

This will again have a result on any physical brick and mortar businesses that haven’t had to close their doors as of yet. But as we’ve already seen a lot of businesses in the events, hospitality and beauty industries have unfortunately had to close their doors – some for good.

While we’re still hoping that all closed sectors of the UK economy will be able to re-open by the 21st of June 2021, let’s now look back at how these industries have been affected over the last 6-12 months in more depth.

Sentiment by industry

Automotive

Businesses in the Automotive industry reported that 72% had been in business for ten years or more, 17% between 5 and 10 years and 11% were in their first year of business. The majority of respondents in this industry were located in the South East, shortly followed by the West Midlands, Yorks and Humber and the North East.

Unsurprisingly, 45% of respondents reported that they owned both an ecommerce business and a brick and mortar business. With 88% retaining their brick and mortar premises with no plans to close whilst the remaining 12% are considering permanently closing their brick and mortar premises to move to online only.

88% plan to retain their brick and mortar premises with no plans to close

This of course has been a result of the UK lockdown and COVID-19 restrictions however, 39% states that they saw an increase in sales over the past year, 27% reported a decrease and 33% reported no major change in their sales levels.

Respondents in this industry stated that their biggest concerns throughout the pandemic were split mainly between business funding, an increase in orders and a decrease in orders. Shortly followed by cash flow and others which included ‘stock shortages’ product supply’ and ‘no other concerns’.

Half of the respondents in this industry reported no effects on their business due to the lockdowns and COVID-19 restrictions. Whilst 33% reported that they had to furlough staff and 28% could only offer delivery.

Over 50% also reported that they had experienced delays in restocking in the past 12 months and 40% stated delays of a few months, 30% stated a few weeks. 20% stated a few days and 10% stated three months or longer.

Over half of the respondents in this industry reported delays in restocking products

Whilst the majority of respondents stated that their sales volumes of purchases from customers based in the EU were roughly the same, 28% reported that sales to EU customers had decreased while 11% stated sales had increased.

As a result of this, 22% have switched or are looking to switch to non-EU suppliers for some products and 39% are not. 39% also state that this question does not apply to them, most likely due to sourcing products from within the UK or elsewhere.

The rise in costs of sourcing and shipping products to and from the EU, 16% stated that they were going to absorb the additional costs into the business whilst 16% were going to pass all the costs onto their customers. However, half stated that they were going to approach with a combination of both.

“Sales dropped in the first few weeks of each lockdown but then increased quite considerably afterwards so it all evened out.”

“The lockdown has finally given me time/motivation to revamp the website with your evolution team. I feel the shift to online selling/buying as a direct result of Covid will not decline once we return to normal. Brexit is a disaster for me – I have traded with Europe for 30 + years and remember before we had open borders – its a real massive backwards step and going to cause online selling problems to EU countries for many years to come. A big thanks to all at EKM for their help in these difficult times.”

Books & Literature

Of those in the Books & Literature sector, 63% reported that they had been in business for 10 years or more. With a quarter being in business between 5 and 10 years and 12% being in their first or second year of business.

A quarter of respondents noted that they were located in the West Midlands with the rest of the respondents being evenly split between, the North West, East Midlands, South West, East Anglia, London and the South East of the UK.

Only a quarter reported that they also owned a brick and mortar business whilst the majority were online-only businesses. However, half of those who own brick and mortar premises stated that they had to close and do not plan on re-opening. While the other half have retained their brick and mortar premises with no plans to close them.

50% of those with a brick and mortar business had to close with no plan to re-open

Although online seems to have made a huge impact within this industry, as 63% reported that their sales had increased in the past year with only 13% reporting decreases and a quartered reporting no major change.

38% of respondents reported that an increase in orders was their main concern followed by cash flow and a decrease in orders. The other half reported ‘other’ concerns which included ‘lack of funding’, ‘obtaining stock’, and ‘postage/courier services’.

Businesses in this industry saw that they could only offer delivery (63%) whilst the remaining (37%) saw no other effects to the UK lockdown and COVID-19 restrictions.

While the majority (63%) reported they hadn’t experienced any delays in restocking products, 37% did. One third stated that the longest delay they experienced was a few months, another third reported delays of a few days whilst the remaining third reported delays of 3 months or more. Meanwhile only a quarter stated that sales volumes to EU customers had decreased since the end of the transition period. Resulting in the majority of respondents, around 63%, not looking to switch their suppliers. Whilst a quarter have decided to switch to non-EU suppliers for their products.

38% are reporting that they are planning to absorb the additional costs associated with trading with the EU, whilst a quarter are planning to pass the costs onto customers and another quarter are planning to do a combination of both.

“I have experienced a minor increase in time spent on customs paperwork. This arises because sales to customers in EU countries are now included in those sales that need to identify the country of origin of the products sold.”

“We have seen a dramatic rise in our high street shop turnover with rises on the internet. We have been very grateful to receive local lockdown grants.”

Clothing

Participants in this industry report that over 45% had been in business for 10 years or more, 30% had been in business for 5-10 years, 19% were in their first two years of business and the remainder had been in business between 3-4 years.

The majority of businesses in this industry were located in the North West, closely followed by the South East. As expected 65% of respondents in this industry stated that they also owned a brick and mortar business as well as their online shop. Of those who own brick and mortar businesses, 100% stated that they retained their premises and have no plans to close them.

100% of respondents in this industry stated that they retained their brick and mortar business

Over 46% saw an increase in sales over the last 12 months and just over 42% saw a decrease in sales. While 11% saw no major changes. Their major concerns were cash flow, a decrease in orders and other factors such as ‘lack of stock’, ‘supply delays’, ‘increase in returns’.

A huge 42% of these businesses have had to furlough their staff whilst just under 20% had to close their business completely and 3% shut permanently. 38% could only offer delivery and 35% could only offer click & collect services under the restrictions. Whilst 30% reported no other effects to their business during this time.

Nearly three-quarters of respondents in this industry reported experiencing delays in restocking some items within the past 12 months. Almost half reported delays of a few weeks, over a quarter reported delays of a few months, 16% reported delays of three months or longer and 10% reported delays of just a few days.

Nearly three-quarters reported delays in restocking products

However, 62% reported a similar sales volume to that of previous volumes before the transition period ended. While another 35% reported a decrease in sales volumes to the EU and 4% reported an increase. Over one-quarter are looking to or have already switched to non-EU suppliers whilst almost 58% have not switched and have no plans to.

Only 19% report that they will be absorbing additional costs due to trading with the EU whilst 12% state they will pass the costs onto the customer. Meanwhile half of the respondents are doing a combination of both.

“Goods dependant on licence holders in EU or GB – no alternative suppliers for products – Brexit increasing costs and reducing sales significantly – question of viability”

“My EU customer base won’t order now owing to fears over taxes and handling. I can’t in good faith send products over there knowing they will be lumped with big charges unless they agree to pick them up. I also cannot absorb them into my product pricing as I would start running at a loss. Basically, I’ve lost the EU customers.”

“Currently cannot get fabric from my supplier in the Netherlands, they can’t find anyone to ship it with at a reasonable cost”

Crafts

Just under 90% of respondents in this industry stated that they had been in business for 10+ years with the rest being in business for between 3-4 years and 5-10 years. Their businesses were located in the South West (26%), Yorks & Humber (13%), West Midlands (13%), South East (13%), North West (7%), Wales (7%), East Anglia (7%) and East Midlands (7%) and London (7%).

60% reported that they also owned a brick and mortar business as well as their online business. 100% of those with brick and mortar businesses stated that they were retaining their brick and mortar with no plans to close.

60% reported owning a brick and mortar business and 100% plan to retain and re-open

In this industry, 47% of respondents reported that they had seen an increase in sales over the past year whilst 40% reported a decrease. 13% saw no major change. This group was concerned about an increase in orders and a decrease in orders with the majority offering other concerns including ‘staff and personal health welfare’, ‘inability to open’ and ‘no teaching available due to social distancing’.

Other effects for this industry include 60% who could only offer delivery, 33% who had to furlough staff and 26% who could only offer click & collect services. 40% also reported that they had seen no other effects from lockdowns and COVID-19 restrictions.

Over half reported that they had experienced delays restocking items for their businesses. 63% said they experienced delays of just a few weeks whilst 13% stated a few months and a quarter stated more than three months.

One-quarter reported delays of three months or more for items

60% noted that they had not seen a change in the volume of sales from EU based customers since the 1st of January 2021. With 33% noting a decrease in sales and 7% noting an increase.

As a result, 20% of participants in this industry are looking to switch or have already switched to non-EU suppliers whilst 40% state they aren’t looking to switch. Of those still trading with the EU, 13% are passing the additional costs onto their customers, 7% are absorbing the costs and 40% are doing a combination of both.

“Many of my past EU customers say they will no longer order as the VAT and import cost issues are too difficult and unpredictable. I only expect this to get worse when the EU introduces the reciprocal system in June.”

“Whilst the business has been trading for nearly 50 years we only started selling online in Nov 2019. We had to close the online business in the 1st lockdown but have kept going with limited staff and hours through the 2nd. Even though our physical shops are closed. A key issue for us is the schools being closed as our staff tend to have young children. Sales through lockdown have been very good. We have just had our best month ever online.”

“We have lost all of our shop sales with the brick & mortar shops closed, but we have seen a transfer to online sales which have increased dramatically, more or less compensating for what we would have earned through footfall sales. But we have had to significantly change our operations, as we are now just basically a packing warehouse rather than a shop. Being a small business, we’ve been able to reinvent, reimagine and adapt our business structure.”

Food & Drink

For business owners in the Food & Drink industry, 38% reported that they had been in business for 10 years or more, followed by 23% reporting having only been in business for 1-2 years. 15% had been in business for 3-4 years and 15% for 5-10 years, whilst only 7% were in the first year of business.

Nearly a quarter of respondents are based in the London area, with 15% then being based in the South East and 15% in the West Midlands. The remaining were evenly based across, East Anglia, South West, North West, North East, Yorks & Humber and East Midlands.

Almost 70% stated that they did not own a brick and mortar business and were online only. For those with brick and mortar businesses, 100% noted that they were retaining their premises and have no plans to close.

70% reported that they operated online only in this industry

Unsurprisingly, over 60% reported that they saw an increase in sales over the past year, with only 15% reporting a decrease and 23% reporting no major change.

Their largest concern since the first lockdown was an increase in orders, followed by cash flow, a decrease in orders and business funding. Other concerns included ‘the ability to get stock and deliver’, ‘staffing’, ‘capacity/time’.

Amazingly, over half reported no other effects to their business regarding the lockdowns and COVID-19 restrictions. With 30%, unfortunately, having to furlough staff and the remaining could only offer delivery, click & collect and some had to close permanently.

Over 75% also reported delays in restocking some items due to the new EU trading rules. 40% noted experience delays of a few months, 30% a few weeks, 20% a few weeks and 10% three months or longer.

46% of participants noted a decrease in sales from EU customers whilst the majority reported that sales volumes were roughly the same. Over 50% stated that they haven’t and are not looking to switch to a non-EU supplier with only 15% noting that they will or have already done so.

Over half stated that they are not looking to switch to a non-EU supplier

15% noted that any increase in costs they were going to pass onto customers whilst another 23% stated that they were going to absorb the costs. The majority (38%) stated that they were going to do a combination of both.

“In terms of takings the brick and mortar are nearly 100k down in terms of turnover but the website has made that up so it evened out….”

“More parcels going missing and un-patient customers contacting regarding orders. Dealing with this has taken up valuable time.”

“We are a tea merchant. We have to import and even with our very established supply lines it has been chaos.”

Garden / Outdoor

The majority of businesses within this industry noted they had been in business for 10 years or more with the remainder split between 5-10 years and 0-1 year.

Businesses in this industry are located across a wide area of the UK, with the majority being in the South East, East Anglia and West Midlands. Others include; East Midlands, Yorks & Humber, Wales, South West and London.

Just under 60% reported that they only operated their businesses online and for those who own a brick and mortar shop, 80% planned on retaining it and have no plans to close. Whilst another 20% are considering permanently closing their brick and mortar shop to go purely online.

20% are considering permanently closing their brick and mortar shops

Almost three-quarters of respondents in this industry reported that they saw an increase in sales over the past 12 months, with 16% reporting decreases in sales and 16% reporting no major change.

Business owners in this industry state that their biggest concern was a decrease in orders with an increase in orders and cash flow and funding falling shortly behind. Other responses included, ‘increased costs of materials’, ‘increasing legislation or taxation’, and ‘courier and delivery’.

Unsurprisingly, over 40% reported no other effects to their business, while 33% said they could now only offer delivery, 17% had to furlough staff and 8% could only offer click and collect.

Two-thirds of respondents noted that they had experienced restocking issues within the last 12 months. 50% reported delays of only a few weeks, whilst one-quarter reported delays of a few months and the remaining reported delays of three months or longer.

41% stated that sales volumes to EU customers had decreased whilst the majority had seen no major change in sales volumes to the EU. With that being said, 25% are switching or are looking to switch to non-EU suppliers and another 25% are not looking to switch. With the other 50% reporting ‘not applicable’.

Just under half of the respondents reported decreased sales to EU customers

Over 30% of respondents in this industry are choosing to pass on increased costs from trading with the EU to customers. While only 8% are absorbing the cost and 50% are doing a combination of both.

“Brexit has meant my small business has had to stop trading with Europe altogether, which means I cannot get many of the plants I need from the Netherlands anymore, nor can I send them to other EU countries. Covid Lockdowns have actually boosted my sales enormously so that I need to employ new help.”

“Our main trade is UK Mail Order retail of plants, 70% of which are UK grown, the remainder I import from The Netherlands. Import times have increased as will costs soon. I have stopped exporting goods back to the EU because plants are perishable and this area of our trade being small it is simply not worth the time or risk to us. Suppliers in the UK have struggled to fulfil supply because demand is so high from new competitors setting up online stores.”

Gifts

Over 50% of respondents in this industry reported being in business for between 5 and 10 years, 28% reported being in business for 10 years or more, while the remaining reported being in business for between 0-1 year and 1-2 years.

The majority of respondents reported that their businesses were located in Yorks & Humber and the South West. The remaining respondents were located in the South East (21%), the North West (14%), West Midlands (7%), East Anglia (7%), and London (7%).

Nearly 80% reported that they only ran an online business with a small minority owning brick and mortar shops. 100% of those with brick and mortar shops planned to retain them and have no plans to close.

80% of respondents said they ran online-only businesses

64% reported an increase in sales over the past year, with only 21% reporting a decrease and 14% reporting no major changes. Their biggest concern was cash flow (42%), followed by business funding (14%), an increase in orders (14%) and a decrease in orders (14%).

A huge 71% saw no additional effect to their business. While others could only offer delivery (28%), some had to furlough staff (7%), some could only offer click and collect (7%), and some, unfortunately, had to close completely (7%).

Nearly two-thirds reported experiencing delays in restocking items with 44% reporting delays of a few weeks, 33% reporting delays of a few months and 22% reporting delays of three months or more.

22% reported delays of 3 months or more

Nearly three-quarters of respondents in this industry reported that sales volumes to EU customers had gone mostly unchanged. And 28% reporting a decrease in sales volumes. 50% noted that they have not switched and are not looking to switch suppliers whilst 7% either already have or are considering it.

21% stated that any increase in costs they were planning to pass this onto customers whilst 14% planned to absorb the cost. Whilst over 40% said that they had planned to do a combination of both.

“Although we are an online shop we sometimes do stalls at events which no longer happen at the moment”

“The biggest issue has been accessing my goods and raw materials such as wax. Sales have increased significantly.”

“Brexit has not really affected my business, most of my stock comes from outside of the EU. Covid has been strange for the business as some parts are up and others well down. Sourcing stock from overseas during lockdowns and shipping stock and seeing it stuck in airports for weeks has been hard.”

“Brexit has caused long delays at inward shipments at ports. Two container vessels bypassed Felixstowe and made other calls first. Shipments to EU customers taking weeks rather than days.”

Health & Beauty / Makeup & Cosmetics

Respondents in this industry have been in business for a range of years. 41% noted they had been in business for ten years or more, and 25% were within their first year of business. 16% had been in business for between 1-2 years and 8% had been in business for 3-4 years and 5-10 years.

A quarter of respondents in this industry are located in the North West with the remaining scattered across the UK including; East Midlands (16%), London (16), East Anglia (16%), Yorks & Humber (8%), and Scotland (8%).

Only a quarter of respondents noted that they owned a brick and mortar business.100% stated that they are planning to retain their brick and mortar shop and have no plans to close.

Almost half of the respondents noted an increase in sales

Almost half of the respondents (41%) reported that they saw an increase in sales, with a quarter noting a decrease and 33% noting no major change. Their biggest concern was cash flow (33%) shortly followed by business funding (25%) and an increase in orders (25%). Only 8% noted concern of a decrease in orders. Other concerns included ‘supplies from US and EU’, ‘product shortages and delays’, and ‘delays on deliveries from suppliers with out of stock issues’.

Over 65% reported that they had experienced no other effects while others reported that they could only offer delivery (25%), some only offering click and collect (8%) whilst some had to close their business completely (16%).

58% of respondents in this industry reported that they had experienced delays in restocking some items. The majority noted a delay of a few weeks (85%) and 14% noting a delay of a few months.

85% reported experiencing delays of a few weeks

Respondent also noted that their sales volumes to EU customers were roughly the same (58%) whilst the remaining noted a decrease in sales volumes. Nearly half of respondents in this industry are not looking to switch to non-EU suppliers whilst 25% are and 33% reported as ‘not applicable’.

8% of participants note that an increase in costs will be passed onto their customers, meanwhile, 16% are absorbing the cost into their business. Half are doing a combination of both.

“We have not been entitled to any Covid support. I had to let one member of staff go – one-fifth of the workforce.”

“We have stopped mailing to countries outside the UK mainland including Northern Ireland due to Brexit paperwork and taxes.”

“The delays of deliveries to Europe is very stressful at present both for me and the buyers. Especially to France, Sweden, Norway & Netherlands”

Hobbies

Respondents in this industry reported that 57% had been in business for 10 years or more, 14% had been in business for 5-10 years, 19% for 1-2 years, 4% between 3-4 years and 4% are in their first year of business.

Almost a quarter of respondents noted that they were located in the South East and East Anglia areas. 14% noted that they were located in the South West, with just under 10% in the North West and Yorks & Humber areas. Other areas include London (5%), Scotland (5%) and the West Midlands (5%).

Nearly half the respondents in this industry (43%) reported that they also owned brick and mortar businesses. 100% of those respondents stated that they planned to retain their brick and mortar premises and have no plans to close them.

Over 50% of respondents reported an increase in sales

Over 50% of respondents reported an increase in sales over the last 12 months, with 19% noting a decrease and 28% noting no major changes. Their largest concern was cash flow (28%), shortly followed by a decrease in orders (23%) and an increase in orders (14%). Other concerns included, ‘a lack of obtaining stock’, ‘unable to attend exhibitions’, and ‘reduced staff due to shielding’.

Other effects noted are that 28% had furlough staff, 28% could only offer delivery options, 14% had to close completely and 5% could only offer click & collect. A large proportion of participants, 42% noted that they saw no additional effects due to lockdowns and COVID-19 restrictions.

Nearly three-quarters of respondents in this industry reported that they experience delays in restocking items over the past 12 months. 40% reported delays of a few months, 33% reported delays of a few weeks, 20% reported delays of three months or more and 6% reported delays of a few days.

Interestingly, only 38% noted a decrease in sales volumes to EU customers since the 1st of January 2021. And 61% noted no major change in sales volumes. Over 55% of participants said that they have not switched and are not looking to switch to a non-EU supplier, whilst 14% are or already have. 28% noted this as ‘not applicable’.

Nearly 20% plan to pass on any increase in cost from trading with the EU to their customers, whilst 5% plan to absorb the cost. A massive 61% plan to do a combination of both to tackle any cost increases.

“The effects of Brexit will take some time to be appreciated fully and for customers to realise things will get more expensive. Having the physical shop shut has limited what we do as most customers for piano and early keyboards want to visit to try before they buy but we are a niche market in this sense.”

“EU orders (usually around 20% of my business) have virtually disappeared and I haven’t yet managed to get stock in from the EU – I didn’t start ordering again until a couple of weeks ago but things are already being held up by paperwork. Given that my business is specialised in yarns from Scandinavia, this is a big concern.”

Home Improvement & Furnishings

Participants in this industry reported that 50% of them had been in business for 10 years or more, 28% had been in business for between 5 and 10 years. Whilst only 9% reported they had been in business for 3-4 years and 9% were in their first year of business.

A quarter of participants were located in the South West of the UK, with 15% in the West Midlands, 12% in the South East and 9% in the North West. The remainder were spread across Northern Ireland (6%), Wales (3%), Scotland (3%), Yorks & Humber (6%), East Midlands (6%), East Anglia (6%) and London (3%).

Just over a quarter of respondents (28%) noted that they also ran brick and mortar shops. Of those 100% said they were retaining their premises and had no plans to close.

Over 55% saw an increase in sales over the past 12 months

Fortunately, over 55% saw an increase in sales over the past year, with 37% reporting a decrease in sales and 6% reporting no major change. The largest concern for this industry was cash flow (37%), followed by a decrease in orders (31%), an increase in orders (25%), and business funding (15%). Other concerns include ‘stock supply’, ‘Brexit’, and ‘staffing’.

Other effects business owners in this industry reported that 25% could only offer delivery, 9% could only offer click & collect 18%, had to furlough staff and 15% had to close completely. Half of the respondents reported no other effects to their businesses.

Almost three-quarters of respondents reported that they had experienced delays restocking items over the past 12 months. Delays ranged from a few weeks (43%), to a few months (30%) and even three months or longer (26%).

Three-quarters of respondents reported they experienced delays restocking items

40% stated that sales volumes to EU customers have decreased since January 2021, however, 59% stated that sales volumes were roughly the same. 18% noted that they have switched or are looking to switch to non-EU suppliers while 50% notes that they are not. 25% of respondents stated that any costs associated with trading with the EU, they were going to pass onto customers, while 12% said they were going to absorb the cost into the business. 34% noted that they were going to do a combination of both.

“We had an increase in sales initially but due to our suppliers losing production time in the initial lockdown they were unable to provide enough stock between October and January leading to a massive loss of sales.”

“The major challenge has been sourcing stock to actually sell. Some products are `on allocation` from manufacturers so we simply have to wait in line to be allowed to order and some products are being quoted up to 26 weeks for delivery”

“For over three 6 weeks now we have been unable to get our materials because of border closures, customs, and transport companies finding vehicles willing to come to the UK. Our factory is now at a standstill, and all the UK lampshade manufacturers (not far east importers) that make and sell to retailers will also come to a halt in production.”

“It’s the worst time we’ve ever experienced, this includes the 2008 crash, which we survived, but only just. this is much, much worse. sales have basically tanked, staff first furloughed, now redundant, (4 altogether) sad really been with the company from way back. tough, really tough, we might not survive. no govt help at all, as I am the business & I’m also self-employed paying myself & the staff from profits, & did not set up the company as limited, short-sighted but we are where we are.”

Jewellery / Watches

Business owners in this industry reported that 60% had been in business for 10 years or more, 20% had been in business for between 3-4 years and 20% had been in business for 1-2 years. 40% reported that they were located in East Anglia, 20% located in the West Midlands, 20% located in Yorks & Humber and 20% located in the North West.

Only 20% noted that they owned a brick and mortar business as well as an online shop. 100% of those who owned a brick and mortar business planned to retain the premises and had no plans to close.

80% of respondents in the jewellery industry ran online-only businesses

40% reported that they had seen an increase in sales over the past year whilst the remaining reported no major change. This group’s largest concern was business funding (40%) and cash flow (40%), with 20% concerned about an increase in orders. Other concerns included, ‘wanting to open for business and missing out on sales.

Other effects that business owners in this industry saw was that 40% could only offer delivery and 20% could only offer click and collect. 60% saw no other effects.

60% reported that they had experienced delays in restocking items over the past 12 months. With 33% reporting delays of a few days, 33% reporting delays of a few weeks and 33% reporting delays of three months or longer. 100% of participants in this industry also indicated that sales volumes to EU customers were roughly the same since January 1st 2021.

60% of respondents in this industry reported delays restocking items

60% of respondents also reported that they have not switched and are not looking to switch to non-EU suppliers for their products. 40% reported this as ‘not applicable’. Any increase in costs from trading with the EU, 20% reported that they would be passing this cost onto customers. While 20% said they would be both passing the cost on and absorbing the cost into the business. 60% reported this as ‘not applicable’, most likely meaning that they source their products from elsewhere.

“We have experienced a big increase in online shopping both through our EKM shop and through other sites. This has been largely offset by brick & mortar shops that we sell through though.”

Specialist Retailer (I.e. Aviation)

Just under 70% of respondents in the specialist retailer industry noted that they had been in business for 10 years or more. 17% had been in business for between 3-4 years,11% between 5-10 years and 3% between 1-2 years.

Businesses in this industry were located across a wide area of the UK including; The South West (23%), South East (17%), West Midlands (11%), East Midlands (11%), Yorks & Humber (8%), the North West (3%), North East (3%), Wales (5%) and Scotland (5%).

Just over half of respondents (53%) reported that they also owned a brick and mortar shop. 88% planned on retaining their premises and had no plans to close. Meanwhile, 5% closed their premises and don’t plan on re-opening and 5% had to permanently close their doors with plans to move to online only.

Over 50% reported that they also owned a brick and mortar shop

44% state that within the past year they had seen a decrease in sales, while only 35% saw an increase and 20% saw no major change. With the largest concern in this industry being a decrease in orders (52%), followed by cash flow (23%), an increase in orders (14%), and business funding (11%). Other concerns in this industry included, ‘Brexit’, ‘Sourcing stock’, ‘lack of digital skills’.

Other effects seen by this industry were that 32% had to furlough staff, 23% could only offer delivery,14% had to close completely, 11% could only offer click & collect. While 38% reported no other effects to their business.

61% of respondents reported that they had experienced delays in restocking over the past 12 months. With 52% reporting delays of a few weeks, 28% reporting delays of three months or more and 19% reporting delays of a few months.

A huge 73% noted that sales volumes to EU customers were roughly the same, while 23% noted that sales volumes had decreased. Only 3% noted that sales volumes had increased. 14% said that they have switched or are looking to switch to non-EU suppliers while 44% that they are not looking to switch suppliers. 41% noted that this question was ‘not applicable’.

Nearly three-quarters are not looking to switch to non-EU suppliers

Nearly a quarter of respondents (23%) are planning on absorbing any additional costs associated with trading with the EU whilst 17% are passing these costs onto their customers. And 44% are planning on doing a combination of both.

“Surprised that after the initial slow down in sales during early lockdown, sales later recovered. It is too early to accurately assess the Brexit impact as January is traditionally a quieter trading month for us. Usually, approx 30% of sales are via the EU, so we are expecting some impact in the future as EU customers become more aware of their potential liability for customs/VAT payments at the point of delivery.”

“Massive issues with getting stock from China. Lack of containers due to increased online shopping, meaning freight companies are increasing prices”

Sports / Recreation

Respondents in this industry reported that 64% had been in business for 10 years or more, 17% had been in business for 5-10 years, 11% had been in business for 3-4 years and 5% were in the first year of business.

Businesses in this industry reported that they were located in the North West (23%), the South West (17%), South East (17%), West Midlands (12%), East Midlands (12%), Yorks & Humber (6%), Wales (6%) and Scotland (6%). Over half (53%) reported that they owned a brick and mortar shop and 100% of those business owners planned to retain their premises and have no plans to close it.

47% saw an increase in sales over the past 12 months

A huge 47% of respondents in this industry saw an increase in sales over the last 12 months, with 35% seeing a decrease and 17% seeing no major change. Their main concerns in this industry are a decrease in orders (41%), cash flow (29%), business funding (12%) and an increase in orders (12%). Other concerns to note were, ‘cancellation of events’, ‘courier issues’ and ‘stock availability’.

Unfortunately, 35% of respondents have had to furlough staff, 35% could only offer delivery, 23% could only offer click & collect, and 5% had to close completely. 29% reported seeing no other effects to their business.

58% of respondents reported that they had experienced delays in restocking items. Half noted delays of three months or more, 30% noted delays of a few months and 20% noted delays of a few weeks.

Over half reported experiencing delays restocking items

Nearly half of respondents (47%) reported that sales volumes had increased sing January 1st 2021, with the remainder reporting that sales volumes were roughly the same. Only 11% reported that they were looking to switch to a non-EU supplier, while 41% were not looking to switch. 47% reported this as ‘not applicable’.

35% of respondents stated that any increase in the cost of trading with the EU they planned to pass onto customers, while 17% planned to absorb this cost into the business. 35% said they planned to do a combination of both.

“Our business relies on importing products from the EU and we have noticed it is much more difficult to import goods at the moment due to Brexit. WE also posted an order to Southern Ireland and it cost £6.70.”

“I have seen an increase in my online presence with more online sales. I would have had more sales if I had the stock that people were looking for. Most of our main stock is forward ordered and we now wait until March to start getting deliveries of things like wetsuits and buoyancy aids. These items saw a big increase in sales last year with everyone staying in the UK.”

Toys & Games

Businesses in this industry reported that 42% have been in business for 10 years or more, 28% had been in business for 3-4 years, 14% had been in business for 5-10 years and 14% were in their first year of business. They reported that they were mainly located in the South East (28%), followed by London (14%), South West (14%), Scotland (14%), North West (14%) and East Midlands (14%).

Only 14% reported that they also owned a brick and mortar shop and 100% of them planned to retain their premises and have no plans to close. 57% stated that they had seen a decrease in sales over the past 12 months, 28% had seen an increase and 14% reported no major change.

57% reported no other effects to their business

Their largest concern was a decrease in orders (28%) and an increase in orders (14%). Other concerns included, ‘reduced footfall’, ‘ stock issues’ and ‘none’. Other effects on their business included that 28% could only offer delivery, 14% could only offer click & collect, 14% had to furlough staff and 14% had to close completely. 57% reported no other effects to their business.

Only 42% noted that they had experienced delays in restocking over the past 12 months. Two-thirds reported delays of a few weeks and one third reported delays of a few months. 85% also noted that sales volumes to EU customers were roughly the same whilst the remaining reported that sales volumes had decreased.

42% reported experiencing delays with restocking items

28% of respondents reported that they have switched or were looking to switch to non-EU suppliers for some items whilst 14% had not. A large portion of respondents (57%) noted this as ‘not applicable’.

Any costs associated with trading with the EU, 14% plan to absorb these costs into the business while 14% plan to partially absorb and pass costs onto customers. 71% noted this as ‘not applicable.

“I am experiencing major delays with receiving stock from my supplier which is based in Germany. I’ve had to refund a lot of orders in January, due to my supplier suspending all shipments to the UK. They are sending orders out again now, but there is a three week time of arrival when it used to be 3-4 days.”

The future of retail and ecommerce

This report gives us a greater understanding of what UK business owners are experiencing even 12 months after the initial wave of lockdowns. While online shopping and ecommerce in general has seen exponential growth shifting people’s shopping and consumption patterns. We may see the return of traditional shopping methods as lockdown restrictions are eased later this year and people return to a resemblance of normality.

We can see that each industry has been affected by the pandemic and Brexit in very different ways, some reaping the benefits of having an already established online presence, whilst others fell to the wayside, having not been prepared for the initial wave of online shopping and some still refusing to get online despite the circumstances. Or unfortunately, some industries that were simply stifled by regulation such as the events industry. This no doubt has and will continue to have a lasting impact.

However, there are those that have used this as an opportunity to evolve and create new avenues of trade. We’ve seen first hand how some business owners have taken the bull by the horns, and pivoted their business 360 degrees to doing daily live streams with customers, sharing advice, attending and presenting webinars and so much more.

And we look to bigger businesses that are making strides in work from home technologies and resources to support their user base as much as possible. And there’s no reason this evolution should stop when we return to normal.

The world of ecommerce is ever-evolving and will continue to do so into the future. It’s something that every business owner needs to be prepared for and get ahead of the curve where they can. Whilst some of the impacts of the pandemic and Brexit have been devastating for some – change opens up new opportunities and we’re still seeing how the world of ecommerce and retail is changing and warping as time goes on.

It may be too early to say what the state of play will be for ecommerce and retail but one thing is certain, and that is ecommerce is here to stay and the rate of its growth and potential may possibly continue for a few years.

*Survey based on a total of 234 anonymous participants from the EKM customer base surveyed during February 2021. For more information or data requests from this survey please contact [email protected].

If you’d like to learn more about setting up your own online shop, read on for more insights into running your own online business here.